Profit Clarity and Money Mindset That Pays Off

Profit Clarity and Money Mindset are two things most creative entrepreneurs never learned—yet they’re essential if you want to feel confident about your money. Let’s be real, most creative entrepreneurs

Profit Clarity and Money Mindset are two things most creative entrepreneurs never learned—yet they’re essential if you want to feel confident about your money. Let’s be real, most creative entrepreneurs

Can I Still Use Profit First If I Have Debt? If you’ve ever asked yourself, “Can I do Profit First with debt?” — the answer is yes. Profit First may

If you’re wondering how often to move your money using the Profit First method, you’re not alone. Setting the right Profit First allocation schedule can make or break your consistency—and

Here’s the truth: The #1 Profit First mistake visionaries make is copying someone else’s percentages instead of creating their own. This method works best when it’s personalized, not duplicated. If

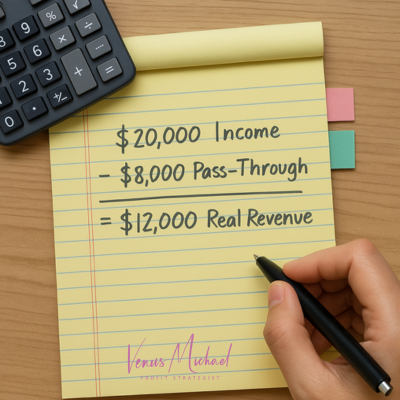

Real Revenue in Profit First: What You Need to Know Most business owners look at income and think, “This is what I made.” However, to truly understand your finances, you

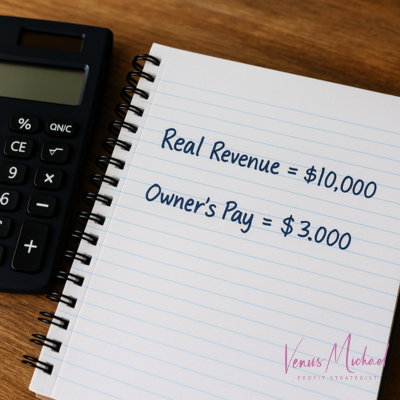

If you’re applying Profit First and there’s not enough left for Owner’s Pay, you’re not alone. This is one of the most common frustrations I hear from entrepreneurs — especially

The “right” Profit First percentages depend on your business size, structure, and season. Start by identifying your real revenue and use the TAPs (Target Allocation Percentages) as a guide, then

If you’re wondering whether Profit First is too rigid, you’re not alone. However, the truth is that it’s a flexible system that can—and should—be adjusted to suit your specific business